The Future of Crypto: What 2025 Holds for Bitcoin, Altcoins, and DeFi

The world of cryptocurrency has never been static, but 2024 was a year of transformation like no other. Bitcoin hit unprecedented milestones, altcoins weathered storms while seizing new opportunities, and DeFi continued to carve out its space in the financial ecosystem. With whispers of Bitcoin surging another 50% and the altcoin market potentially ballooning to $3 trillion in 2025, investors and enthusiasts alike are eagerly watching what comes next.

To get the full scoop, Cointelegraph Research has released an in-depth report analyzing last year’s trends and projecting the crucial developments shaping 2025. Let’s dive into the key takeaways that will define the crypto landscape in the months ahead.

Download the full report for free here.

Bitcoin: Cementing Its Role in Global Finance

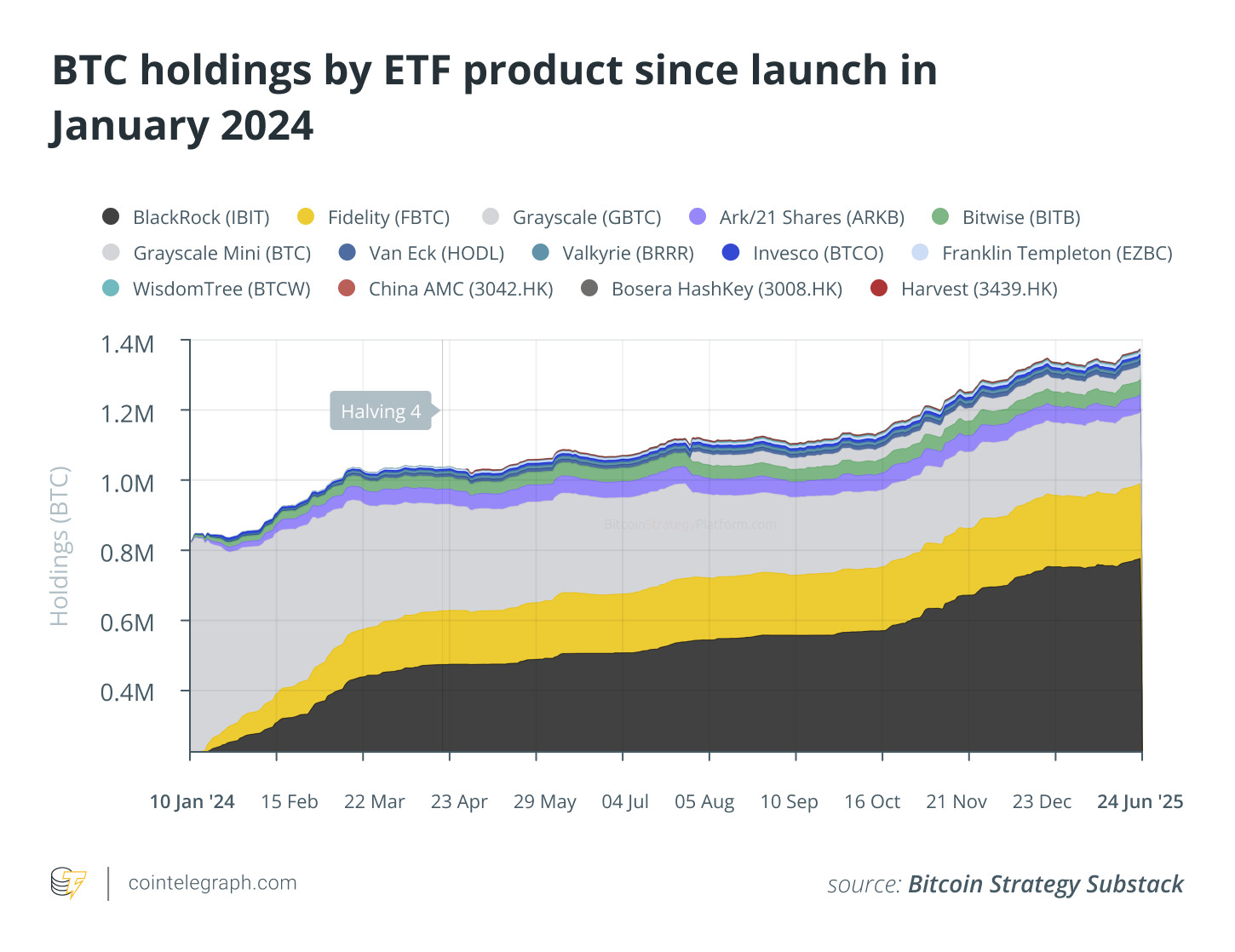

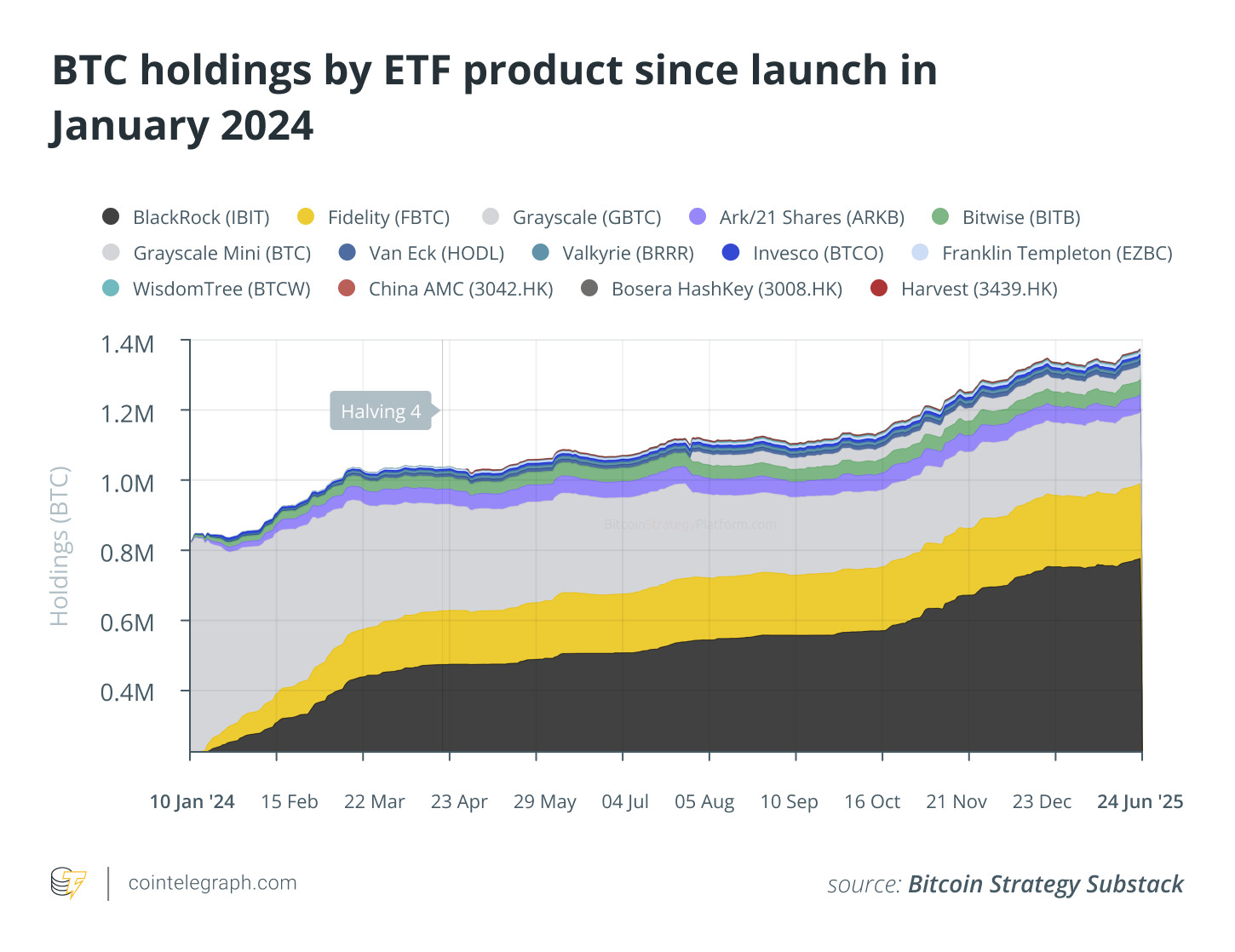

Bitcoin (BTC) has long been heralded as digital gold, but 2024 saw it take a gigantic leap toward financial mainstream acceptance. One major catalyst? The launch of spot Bitcoin ETFs in the United States. These funds gave institutional investors easier access to Bitcoin, triggering massive inflows and pushing BTC’s price over the historic $100,000 mark.

The adoption didn’t stop there. Countries and corporations alike ramped up their Bitcoin holdings, further validating its role as a legitimate asset. With over 1.1 million BTC now locked up in ETF products, discussions about Bitcoin becoming a global reserve asset are taking center stage like never before.

BTC holdings by ETF product since launch in January 2024

BTC holdings by ETF product since launch in January 2024

The question remains: With 2025 on the horizon, will Bitcoin shatter its previous records once again?

Altcoins: A Rollercoaster of Risks and Rewards

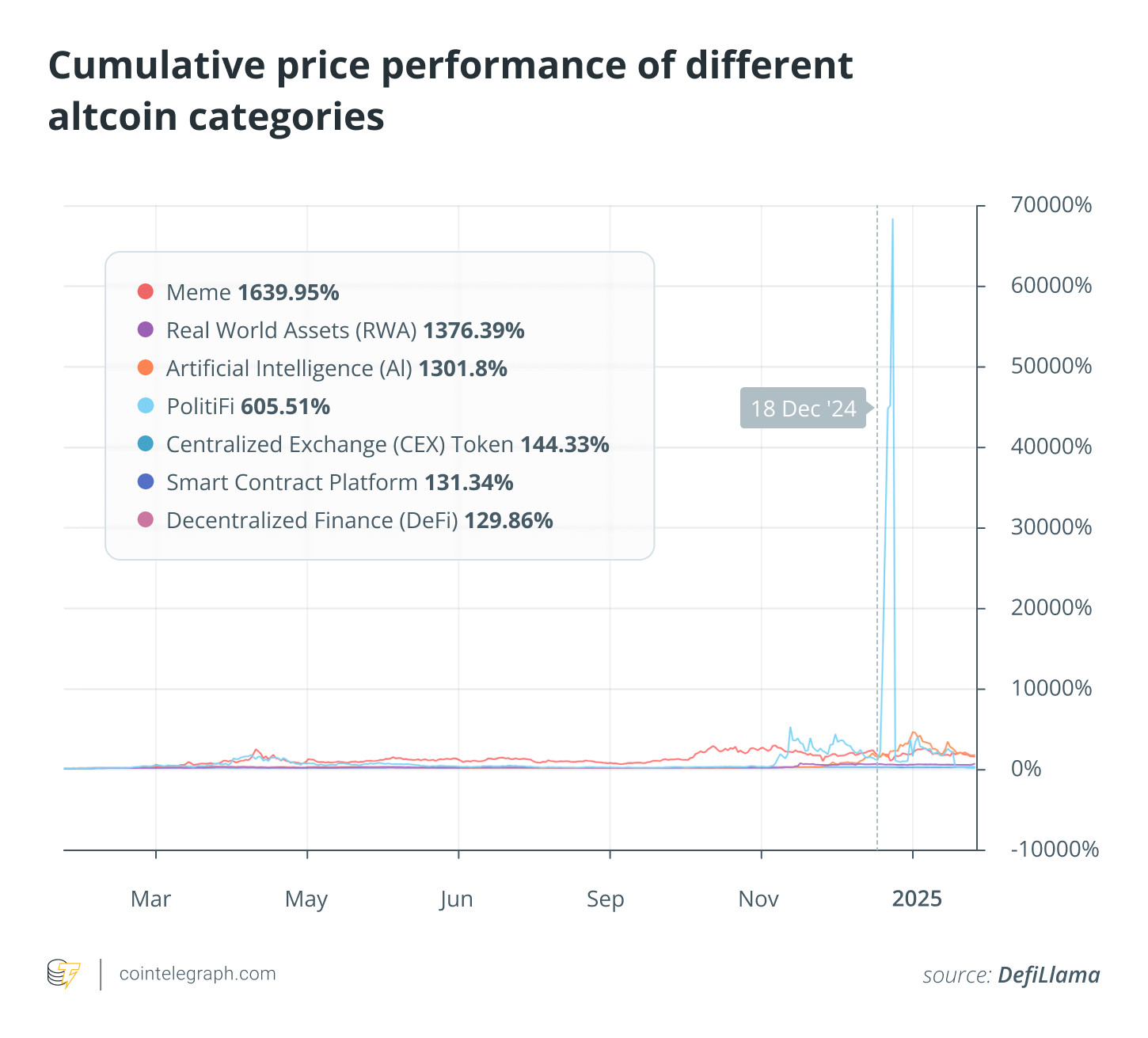

While Bitcoin ruled the headlines, altcoins had a story of their own to tell. The total altcoin market cap surpassed $1.5 trillion for the first time, proving that the ecosystem beyond BTC is expanding. But not all projects had an easy ride.

Certain venture-backed altcoins struggled due to tough macroeconomic conditions, while others — particularly memecoins — defied expectations by capturing investor interest in unexpected ways.

With 2025 likely bringing a renewed appetite for diversification, could we finally see the long-awaited altseason? Investors are keeping a close eye on innovative projects that could reshape the landscape.

Cumulative price performance of different altcoin categories

Cumulative price performance of different altcoin categories

Download the full report for free here.

Crypto Stocks: Winners and Losers in 2024

Crypto-related stocks had a mixed year, with some companies riding Bitcoin’s wave while others grappled with operational hurdles.

Standout performers included MicroStrategy, whose aggressive BTC acquisition strategy paid off handsomely, and Bitdeer, which focused on sustainable mining tech and reaped a 165% stock price increase.

Looking ahead, the trajectory of crypto stocks in 2025 will hinge on broader macroeconomic trends and the industry’s continued push for energy-efficient blockchain solutions.

The Road to 2025: Regulation, DeFi, and the Next Big Trends

Regulatory shake-ups will play a massive role in shaping the next phase of crypto evolution. In Europe, the Markets in Crypto-Assets (MiCA) regulation is raising compliance costs, potentially squeezing smaller players out of the region. Meanwhile, the U.S. could take center stage as a crypto-friendly hub, especially if policy sentiment shifts in favor of innovation.

DeFi is also set for a breakout year. According to projections, the sector’s total value locked (TVL) could soar past $200 billion by year-end. With decentralized exchanges gaining ground and innovations in staking technologies advancing, DeFi could outpace centralized platforms in market significance.

Final Thoughts

With major milestones achieved in 2024 and even bigger opportunities on the horizon, the crypto industry is at a turning point. Investors, developers, and regulators all have crucial roles to play as the next era of digital assets unfolds.

Will Bitcoin breach new highs? Will DeFi disrupt traditional finance even further? Can altcoins sustain their momentum? These are just a few of the pressing questions as we move into 2025. To stay ahead of the curve and unlock insights into these trends, dive into the full report below.

Download the full report for free here.

This article is for informational purposes only and does not constitute financial or investment advice. Always conduct thorough research before making any investment decisions.