2024: The Year Crypto Took the World by Storm

2024 was a landmark year for cryptocurrency, breaking free from its niche status and asserting itself as a dominant force in global finance and technology. A mix of political support, AI innovations, real-world asset tokenization, and fierce blockchain competition reshaped the landscape—setting the stage for an electrifying 2025.

Bitcoin soared amid a high-inflation economy, Wall Street entered the game through Bitcoin ETFs, and Washington, D.C. took notice as President-elect Donald Trump and key lawmakers expressed pro-crypto stances. Meanwhile, Ethereum faced mounting competition from rival smart contract platforms, and Web3 saw explosive growth in AI-driven tokens and real-world asset integrations.

Let’s dive into how all of this unfolded and what it means for the future.

Bitcoin’s Meteoric Rise: Breaking Barriers

As expected, Bitcoin followed its historical post-halving trend in 2024, surging by 126% on the back of growing institutional adoption and newfound political interest. However, this time, it wasn’t just retail investors and Michael Saylor driving the rally—Wall Street had officially entered the chat.

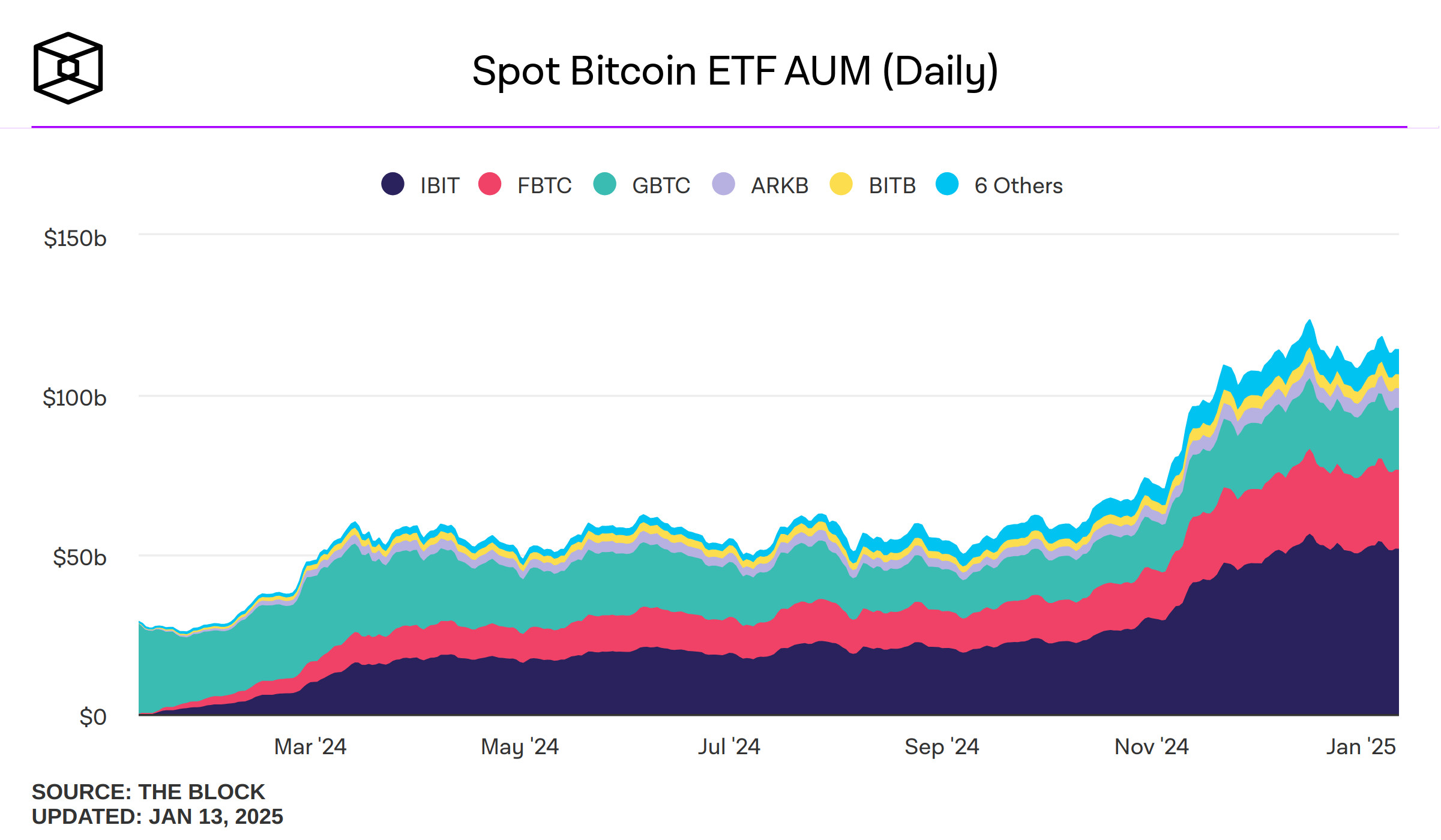

The launch of spot Bitcoin ETFs in January 2024 brought an influx of institutional capital, completely transforming the Bitcoin investment landscape. BlackRock, along with eight other major asset managers, ventured into the space, with Bitcoin ETF assets under management (AUM) rocketing from $27 billion to an astonishing $109 billion by year’s end.

Spot Bitcoin ETF AUM (daily). Source: The Block

Spot Bitcoin ETF AUM (daily). Source: The Block

Adding to the bullish narrative, U.S. Senator Cynthia Lummis introduced the BITCOIN Act, a proposal that could see the U.S. government purchase 1 million BTC as a national strategic asset. While it remains uncertain whether this legislation will pass, the political climate is shifting in Bitcoin’s favor, especially with pro-crypto candidates now holding significant seats in Congress.

As Bitcoin continues to gain credibility as both a financial asset and a political talking point, all eyes are on 2025 to see if new highs are within reach.

The Smart Contract War Heats Up

While many investors are fixated on Bitcoin, much of the innovation in crypto is happening in the smart contract arena. Ethereum faced an uphill battle in 2024, as rivals like Solana aggressively pursued market share.

Solana’s Firedancer upgrade significantly boosted its scalability, while Ethereum deployed its long-awaited Dencun upgrade to reduce layer-2 transaction fees. However, Ethereum’s dominance was still challenged, as faster, cheaper alternatives chipped away at its lead.

In terms of price action, Ethereum’s native token, Ether (ETH), only saw modest growth of 65%, while spot ETH ETFs struggled to gain the same traction as their Bitcoin counterparts. Looking ahead, Ethereum’s forthcoming Pectra upgrade in 2025 could be a game-changer, streamlining account functionality and improving the overall user experience.

But will that be enough to secure Ethereum’s throne in smart contracts? With competitors evolving fast, the battle is far from over.

Web3’s Big Winners: AI and Real-World Assets

The promise of a decentralized web is still evolving, but 2024 provided a glimpse of what’s to come—especially in the realms of AI-driven projects and real-world asset (RWA) tokenization.

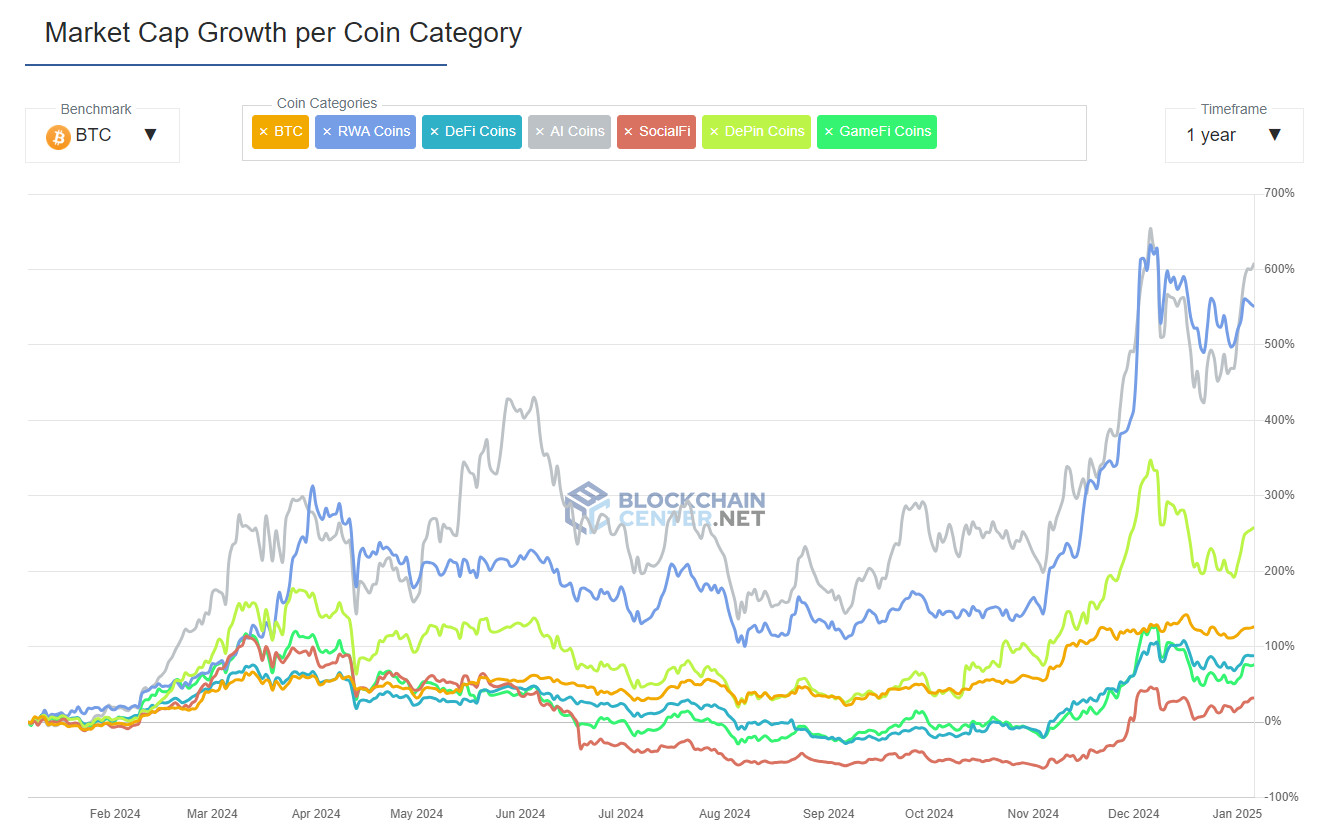

Artificial intelligence projects dominated the year, with AI-focused tokens outperforming nearly every other sector. Render Protocol (RENDER) skyrocketed 125%, machine-learning system Bittensor (TAO) saw a 135% gain, and AI agent protocol Virtuals (VIRTUAL) had a jaw-dropping 33,000% increase. In total, AI tokens surged by 630% in 2024, according to BlockchainCenter.

Right behind AI, real-world asset (RWA) tokens saw impressive growth. Ondo Finance (ONDO) and Mantra (OM)—both offering RWA-focused financial products—surged by 705% and 6,866%, respectively. Even Tether jumped on the trend, launching its asset tokenization platform, Hadron, in November 2024.

Market cap growth per coin category. Source: BlockchainCenter

Market cap growth per coin category. Source: BlockchainCenter

Beyond AI and RWAs, the decentralized physical infrastructure (DePIN) sector gained traction, with a 270% rise in token value. Meanwhile, DeFi saw a massive rebound, with TVL nearly hitting its previous $250 billion all-time high, fueled by the rapid rise of EigenLayer—a restaking protocol that became the world’s third-largest DeFi platform in under a year.

Crypto gaming also experienced a renaissance, with daily active wallets surging from 1.3 million in 2023 to nearly 9 million by the end of 2024.

Looking Ahead: What’s in Store for 2025?

The foundation laid in 2024 has set the stage for what could be an explosive 2025. Bitcoin’s bull run is still in motion, Ethereum is gearing up for crucial network upgrades, and the Web3 ecosystem continues to innovate at an unprecedented pace.

The biggest wildcard? The political landscape. With Donald Trump’s crypto-friendly administration entering office and an increasing number of pro-crypto lawmakers in Congress, regulatory clarity could finally be within reach.

As crypto inches deeper into mainstream finance and technology, one thing is certain: Digital assets are no longer just a speculative play—they’re a transformative force shaping the future of global markets.

This article is for informational purposes only and should not be considered legal or investment advice. The opinions expressed belong solely to the author and do not necessarily reflect those of Cointelegraph.