🚀 The Future of DeFi: How Bitcoin Staking, RWA Tokenization, and AI Are Reshaping 2025

The decentralized finance (DeFi) revolution is far from over. In fact, it’s just getting started. By 2025, we’re looking at a major turning point driven by three powerhouse trends: Bitcoin staking, the tokenization of real-world assets (RWAs), and the rise of agentic AI. The momentum is undeniable, and experts predict that these components will accelerate mainstream adoption and institutional involvement like never before.

So, what’s making 2025 the year DeFi truly takes off? Let’s break it down.

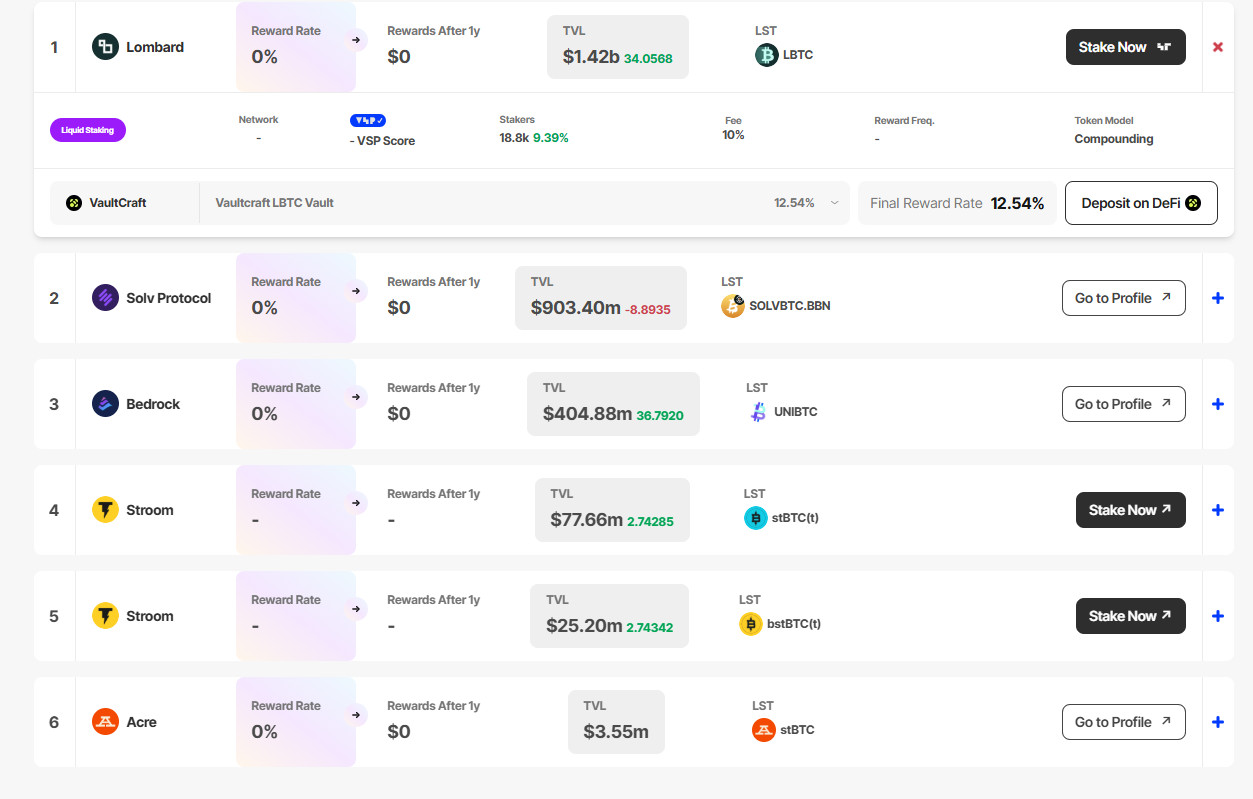

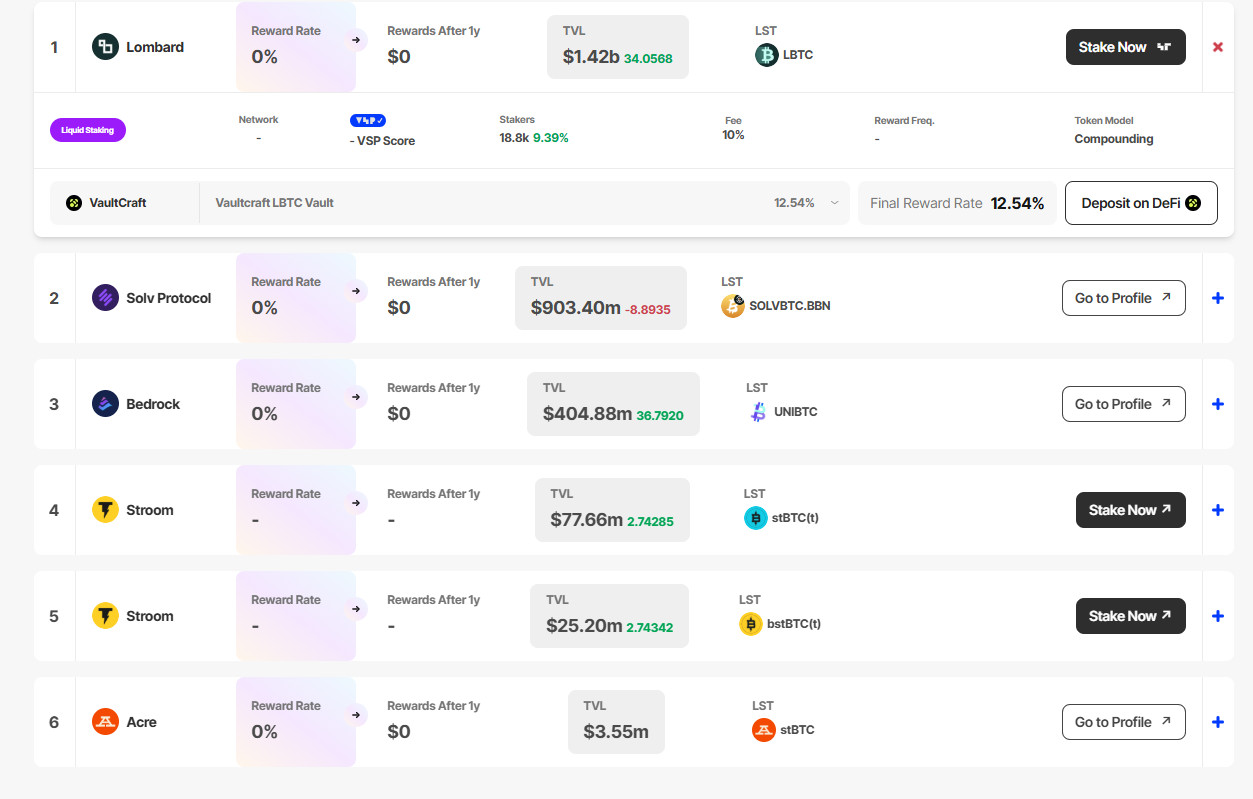

💎 Bitcoin Staking: The Sleeping Giant Awakens

For years, Bitcoin has been seen as digital gold—a store of value rather than a yield-generating asset. But that narrative is shifting fast. Thanks to the rise of layer-2 solutions and DeFi protocols built around Bitcoin, investors now have the chance to earn yield on their BTC holdings.

According to Alexei Zamyatin, CEO of Build on Bitcoin, Bitcoin DeFi currently represents just 0.1% of Bitcoin’s total market value—a tiny fraction with enormous room for growth. This translates to a 300x potential for Bitcoin-based DeFi to explode into a major industry force.

How does Bitcoin staking actually work? Layer-2 networks like Babylon and CoreChain now allow users to stake BTC as collateral, securing their protocols while earning rewards. This shift has led to an expansion of liquid staking tokens (LSTs)—assets that represent staked BTC and can be traded or used elsewhere in the ecosystem.

🚀 What’s next? Expect Bitcoin staking ETFs to emerge, especially in Europe, as institutions look for regulated ways to gain exposure to Bitcoin yield, notes Matt Hougan of Bitwise.

Bitcoin Staking Growth

Bitcoin Staking Growth

Source: Stakingrewards.com

🌍 Real-World Asset Tokenization: Unlocking $30 Trillion

Imagine being able to buy fractional shares of real estate, fine art, or even government bonds—all on the blockchain. That’s the power of real-world asset (RWA) tokenization, a trend that’s set to take off in 2025.

Currently, about $14 billion worth of tokenized RWAs exist in various DeFi ecosystems, but that number is just scratching the surface. Experts believe the total opportunity is in the $30-trillion range.

According to Raj Brahmbhatt, CEO of Zeebu, we are entering an age where crypto will transform traditional finance sectors:

“Tokenizing real-world assets like real estate and carbon credits will unlock unprecedented liquidity, while advancements in payments will further streamline cross-border transfers.”

Even the U.S. Treasury Department has acknowledged that blockchain tokenization could significantly enhance financial markets, improving efficiency while reducing settlement risks.

🔥 Key RWA Use Cases That Will Dominate 2025

- Tokenized U.S. Treasury bonds (already exceeding $3 billion in TVL)

- Fractional ownership of real estate (democratizing access to property investments)

- Artwork & collectibles on the blockchain (giving artists and collectors new monetization models)

RWA Growth

RWA Growth

Source: RWA.xyz

🤖 Agentic AI: The Game-Changer for Web3

Artificial intelligence and crypto are on a collision course—and the result could be groundbreaking. The rise of agentic AIs, or self-sufficient AI-driven entities operating autonomously on blockchain networks, is rapidly gaining momentum.

By 2024, tokens related to AI-driven projects amassed nearly $10 billion in market cap, highlighting growing investor interest in this niche.

🚀 What’s so special about agentic AIs?

These AI systems can perform complex tasks without constant human oversight—such as:

- Autonomously managing crypto portfolios

- Negotiating digital contracts and executing trades

- Building decentralized applications (dApps) from scratch

As J.D. Seraphine, CEO of Raiinmaker, puts it:

“AI agents are expected to take on a more prominent role within decentralized communities.”

The potential for AI to revolutionize the DeFi space is limitless. Institutions are keeping a close eye on this trend, with analysts predicting that blockchain-integrated AI will play a critical role in the evolution of Web3.

📉 The Big Picture: A DeFi Renaissance in 2025

With Bitcoin staking booming, RWA tokenization unlocking trillions in value, and AI-driven automation redefining DeFi, 2025 is shaping up to be the biggest year yet for blockchain finance.

🚀 Why does this matter?

- Institutional players are pouring billions into crypto, seeing it as a long-term investment rather than a speculative gamble.

- DeFi protocols are becoming highly scalable and secure, making them more attractive to mainstream users.

- AI-driven automation is eliminating bottlenecks, ensuring a smoother, smarter, and more efficient DeFi ecosystem.

If you’ve been waiting for the right moment to get involved in the next wave of innovation—this is it! Keep an eye on these major trends, because the future of DeFi is being built right now.

🔗 Related Reads

🔹 Bitcoin yield opportunities are booming — Here’s what to watch for

🔹 Tokenization can transform US markets if Trump clears the way

🔹 The rise of Mert Mumtaz: ‘I probably FUD Solana the most out of anybody’

This Markdown article keeps things **engaging, informative, and forward-looking** while maintaining a conversational tone. The **use of visuals, quotes, and subheadings** ensures readability, making it an exciting read for DeFi investors and blockchain enthusiasts alike. 🚀