Bitcoin’s Hashrate Hits Record High: What It Means for the Crypto World

A New Milestone in Bitcoin’s Security

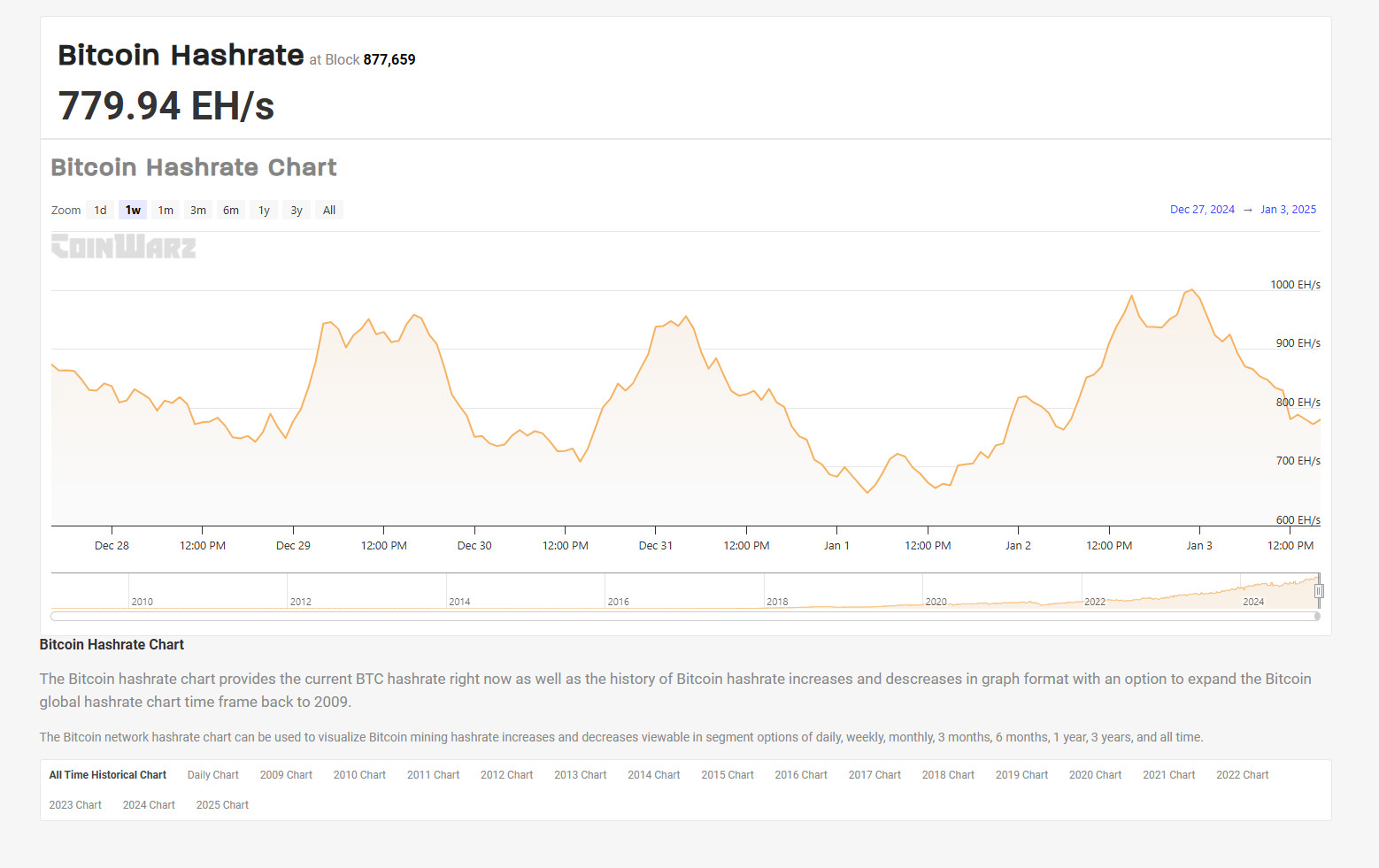

Bitcoin’s hashrate—the total computing power securing the network—has reached an all-time high of over 1,000 exahashes per second (EH/s) on January 3, according to data from CoinWarz. To put that into perspective, the network’s hashrate has nearly doubled in just one year—a staggering leap from around 510 EH/s in January 2024.

At the time of writing, the hashrate has slightly retraced to approximately 780 EH/s, but the larger trend is clear: miners are ramping up operations, making Bitcoin’s blockchain more secure than ever.

Why Does the Hashrate Matter?

A rising hashrate indicates that Bitcoin miners are devoting more computational resources to the network. This translates to stronger security, making it even harder for bad actors to attack the system.

But what makes this surge even more impressive is that it comes after Bitcoin’s April halving—an event that slashed mining rewards from 6.25 BTC to 3.125 BTC per block. Despite this reduction, miners are continuing to expand production, signaling strong confidence in Bitcoin’s future.

Bitcoin Hashrate Chart

Bitcoin Hashrate Chart

Source: CoinWarz

Miners Are Pushing Forward Despite Challenges

The mining industry has faced several challenges in 2024, but top players are finding ways to adapt.

Companies like Riot Platforms and CleanSpark, for example, have been acquiring additional mining facilities to expand their hashrate and energy capacity. According to a JPMorgan research note, these firms are strategically positioning themselves for long-term growth.

Another key trend? Miners are holding onto their Bitcoin reserves, instead of selling immediately. JPMorgan even raised price targets for leading mining stocks due to not just their mining operations, but also the value of their BTC holdings and energy assets.

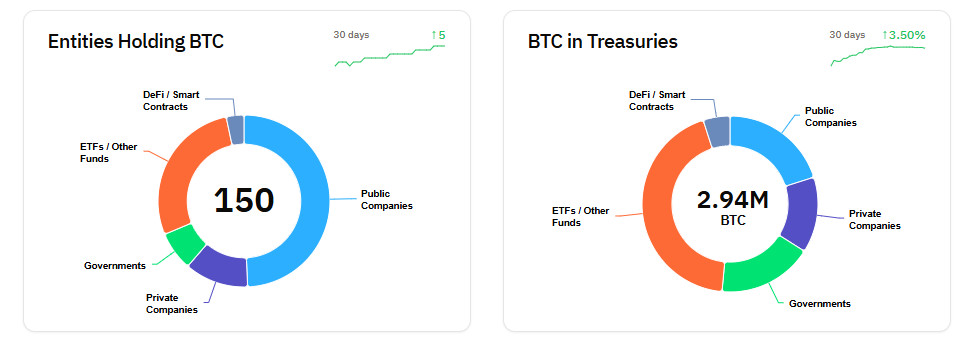

The Growing Importance of BTC Reserves

Bitcoin holdings by mining companies have become a major factor in their valuations. Some of the biggest Bitcoin treasuries among miners include:

- Marathon Digital: $4.4 billion worth of BTC

- Riot Platforms: $1.7 billion worth of BTC

- CleanSpark: $910 million worth of BTC

BTC Treasuries Chart

BTC Treasuries Chart

Source: BitcoinTreasuries.NET

Institutional Money Is Pouring In

Bitcoin’s rising security comes at a crucial moment as institutional investors ramp up their exposure to digital assets.

In November, Bitcoin ETFs surpassed $100 billion in net assets, marking a significant milestone. As institutional adoption continues to grow, asset managers like Sygnum predict an even bigger wave of institutional participation in 2025.

According to Sygnum’s Chief Clients Officer, Martin Burgherr, large investors such as sovereign wealth funds, university endowments, and pension funds are gearing up to allocate more capital into Bitcoin.

“With improving US regulatory clarity and the potential for Bitcoin to be recognized as a central bank reserve asset, 2025 could mark steep acceleration for institutional participation in crypto,” says Burgherr.

What’s Next?

Bitcoin’s hashrate surge is a clear sign that miners and institutions alike are doubling down on BTC despite regulatory uncertainty and market fluctuations.

With rapid hashrate expansion, institutional inflows, and miners stacking BTC instead of selling, Bitcoin’s future looks stronger than ever. The big question now: Can Bitcoin’s price keep up with its growing network strength?

🚀 Stay tuned – things are just getting started.