Bitcoin’s Rollercoaster Ride: What December’s Volatility Tells Us About the Future

A Wild December, or Business as Usual?

If you were watching Bitcoin’s price movements in December, you might have felt like you were on a rollercoaster—sharp climbs followed by nerve-racking drops. The big news? BTC broke past the $100,000 mark but then struggled to stay above it. But according to ARK Invest’s latest Bitcoin Monthly report, that wild price action wasn’t anything unusual.

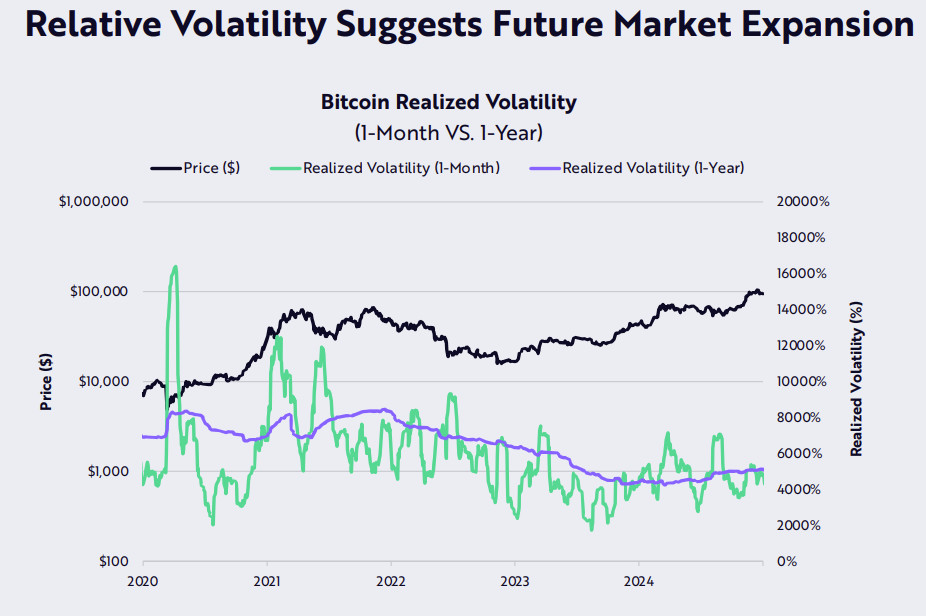

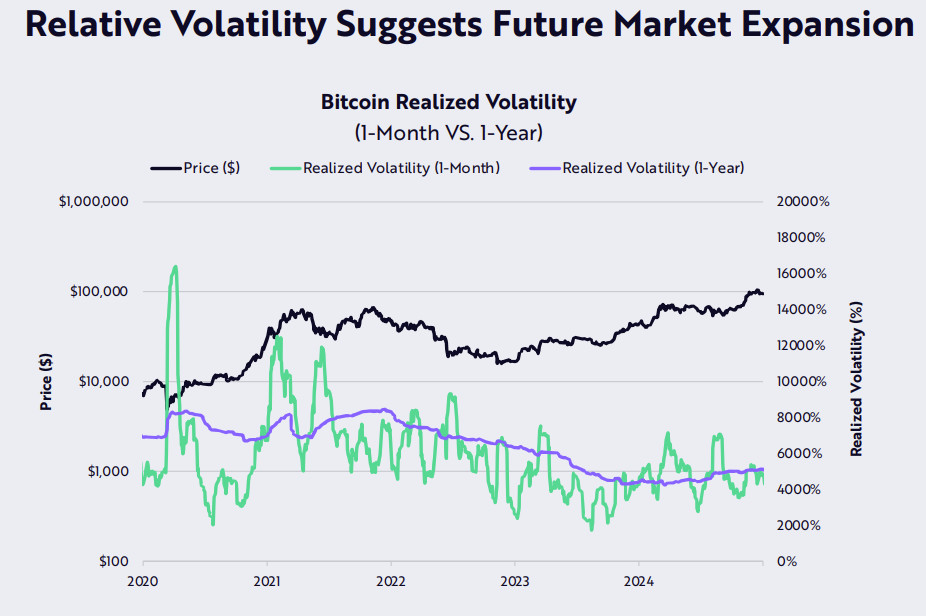

ARK analyzed Bitcoin’s monthly and yearly volatility—essentially, how much its price swings over different time frames—and found that despite the sharp movements, they weren’t historically significant. In fact, Bitcoin’s monthly price swings in December were relatively calm when compared to its annual volatility.

Bitcoin Price, Pantera Capital, Donald Trump

Bitcoin Price, Pantera Capital, Donald Trump

Bitcoin’s monthly volatility (green line) remained modest compared to its yearly volatility (purple line). Source: ARK Invest

What This Means for Bitcoin’s Future

Bitcoin going wild but not too wild is actually a good sign if you’re hoping for further price gains. According to ARK, when volatility remains controlled, it signals that we haven’t yet hit the market’s “mania” phase—meaning there could still be significant upside potential.

With 2025 just getting started, ARK believes there’s room for Bitcoin to expand further. And they aren’t just making guesses—several trends back this optimism.

Strong Holder Confidence

One of the biggest signs? Bitcoin holders are staying put. ARK’s data shows that a massive 62% of BTC supply hasn’t moved in more than a year—even after Bitcoin saw gains of over 100% in 2024. This suggests that long-term investors believe the bull market is far from over.

Additionally, rising mining difficulty and metrics like the short-term holder cost basis point to strong market fundamentals.

Related: How long will Bitcoin’s price consolidation last?

A Crypto-Friendly White House? Trump’s Return Fuels Market Hopes

Bitcoin’s historic push past $100,000 didn’t happen in a vacuum. One major factor? Donald Trump’s election victory.

Love him or hate him, his pro-crypto stance has the market buzzing. During his campaign, Trump made it clear: he wants to turn the U.S. into the global hub for Bitcoin and cryptocurrency.

Key Appointments Signal Big Moves

Political promises are one thing, but Trump’s actions so far suggest he’s serious.

- Paul Atkins—a known crypto advocate—has been tapped to lead the Securities and Exchange Commission (SEC). This could mean massive regulatory shifts favoring digital assets.

- David Sacks—a veteran in tech and crypto—was named Trump’s top adviser for AI and crypto.

Both of these moves have been applauded by the crypto community, fueling the belief that the U.S. may finally embrace Bitcoin with open arms.

Executive Orders Incoming?

According to The Washington Post, Trump is expected to sign crypto-focused executive orders as soon as he takes office on January 20. These orders could provide much-needed clarity on crypto regulation and reinforce Bitcoin’s legitimacy.

Pantera Capital predicts that Trump’s return could trigger another wave of institutional and retail investment, helping Bitcoin set new all-time highs in 2025.

Related: Donald Trump could issue crypto executive orders on first day: Report

The Bottom Line

Bitcoin’s December volatility might have seemed concerning, but in the grand scheme, it’s a normal part of its market cycles. With strong investor confidence, growing institutional interest, and a pro-crypto administration taking charge, the stage is set for a fascinating 2025.

Will Bitcoin continue its climb past $100,000 and set new records? Time will tell, but the signals are looking promising. Buckle up—it’s going to be an exciting ride. 🚀