Solana’s Bright Future, AI Advancements, and the Pulse of DeFi

The world of blockchain and cryptocurrency never stops evolving, and 2025 is shaping up to be another year of groundbreaking developments. From Solana’s potential surge fueled by ETF speculation to the latest advancements in AI-driven blockchain projects, there’s a lot to unpack. Let’s dive into the latest crypto trends, market insights, and game-changing innovations.

Solana: A Year of Big Gains on the Horizon

Could a Solana ETF Ignite a New Bull Run?

Solana ($SOL) has been stealing the spotlight in the crypto sphere, and for good reason. With mounting anticipation of a US-based Solana exchange-traded fund (ETF), analysts predict an influx of retail investors eager to ride the wave.

Despite facing a temporary dip below the psychological $200 mark in early January, experts believe Solana is poised for major financial upside. According to Nicolai Søndergaard, research analyst at Nansen, the driving force behind $SOL’s appeal is its perceived affordability compared to other top cryptocurrencies.

“Solana seems cheaper. When you look at a unit price, it just feels like a more accessible entry point for new investors,” Søndergaard explained.

With increasing adoption and growing optimism surrounding institutional participation, could this be Solana’s year to shine?

Solana Price Chart

Solana Price Chart

SOL/USD monthly chart. Source: Cointelegraph

Read the full story

AI Meets Crypto: Fetch.ai Paves the Way

A $10 Million Boost for AI-Driven Startups

Artificial Intelligence (AI) and blockchain make for a powerful combination, and Fetch.ai is betting big on that future. The Cosmos-based crypto AI company has launched a $10 million accelerator designed to foster AI agent and quantum computing innovations.

Operating through Fetch.ai’s Innovation Lab—with hubs in San Francisco, London, and India—the initiative aims to bridge cutting-edge research with real-world applications. Humayun Sheikh, CEO of Fetch.ai, believes that AI agents will reshape the future of software by acting as a sophisticated execution layer for modern technologies.

“Agents are not only redefining how software is built but also how automation and AI interact within decentralized frameworks,” said Sheikh.

This move could mark a pivotal step in integrating AI-driven solutions within the crypto ecosystem.

Discover more

Europe’s MiCA: A Boon or Burden for Crypto?

Can Regulation Spur More Institutional Investment?

Despite concerns about overregulation, the European Union’s Markets in Crypto-Assets Regulation (MiCA) is considered a game-changer for the global cryptocurrency market. Officially enacted on December 30, 2024, the framework provides comprehensive regulatory clarity for crypto service providers.

While some fear that stricter rules could stifle innovation, experts believe the long-term impact will be overwhelmingly positive. Dmitrij Radin, founder of Zekret and CTO at Fideum, sees MiCA as crucial for market maturation.

“Every regulation helps the industry mature. Over time, it will attract more funds and more users,” said Radin.

However, regulatory scrutiny could increase, especially for retail traders and crypto platforms, as governments work to pinpoint vulnerabilities in the financial system.

Read more

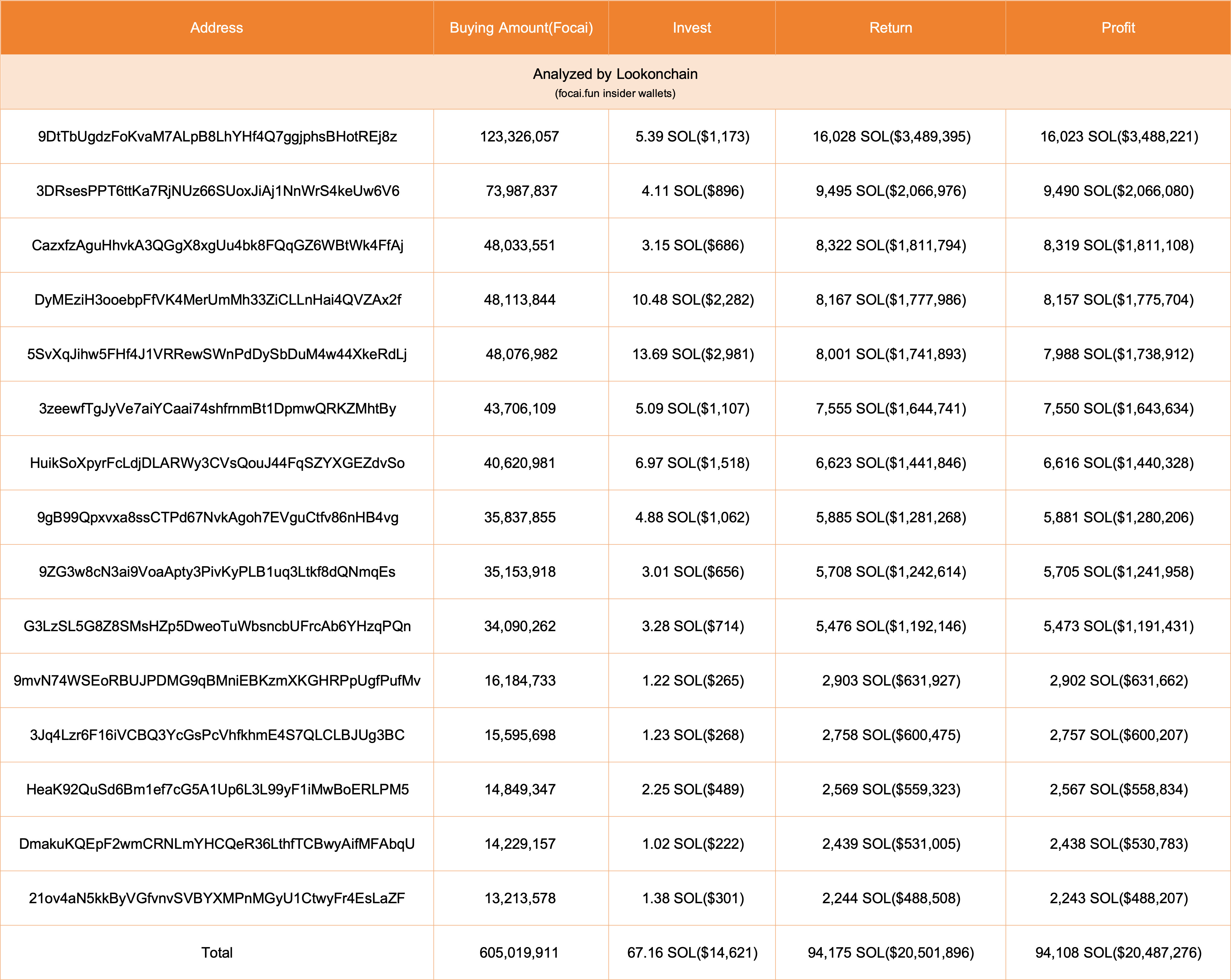

Insider Trading Hits Solana’s Memecoin Market

Wallets Allegedly Amass $20 Million in Dubious Gains

A fresh controversy is brewing in the Solana ecosystem after blockchain sleuths uncovered what looks like a textbook case of insider trading. At least 15 wallets reportedly turned a tiny $14,600 investment into a staggering $20 million profit by strategically trading Focai.fun (FOCAI), a newly launched memecoin on the Pump.fun platform.

The wallets allegedly controlled over 60.5% of the total FOCAI supply, only to offload their holdings for massive gains. The eyebrow-raising trade raises questions about fairness and decentralization in crypto trading.

“They then sold all their $FOCAI for 94,175 $SOL ($20.5M), netting 94,108 $SOL ($20.48M),” revealed analytics firm Lookonchain.

Instances like these reinforce the challenges of achieving true decentralization in the memecoin markets.

FOCAI Insider Trading

FOCAI Insider Trading

FOCAI insider wallets. Source: Lookonchain

See full report

Ripple and Chainlink Join Forces

Powering the RLUSD Stablecoin in DeFi Markets

Ripple is taking steps to boost the presence of its Ripple USD (RLUSD) stablecoin in decentralized finance (DeFi) markets. A new collaboration with Chainlink aims to provide secure price feeds for RLUSD on Ethereum and the XRP Ledger, improving its credibility and usability.

The partnership seeks to enhance liquidity and enable RLUSD to thrive in DeFi applications by leveraging Chainlink’s tamper-proof oracle data. With accurate price feeds and decentralization at the core, RLUSD could become a dominant player in stablecoin transactions.

More details here

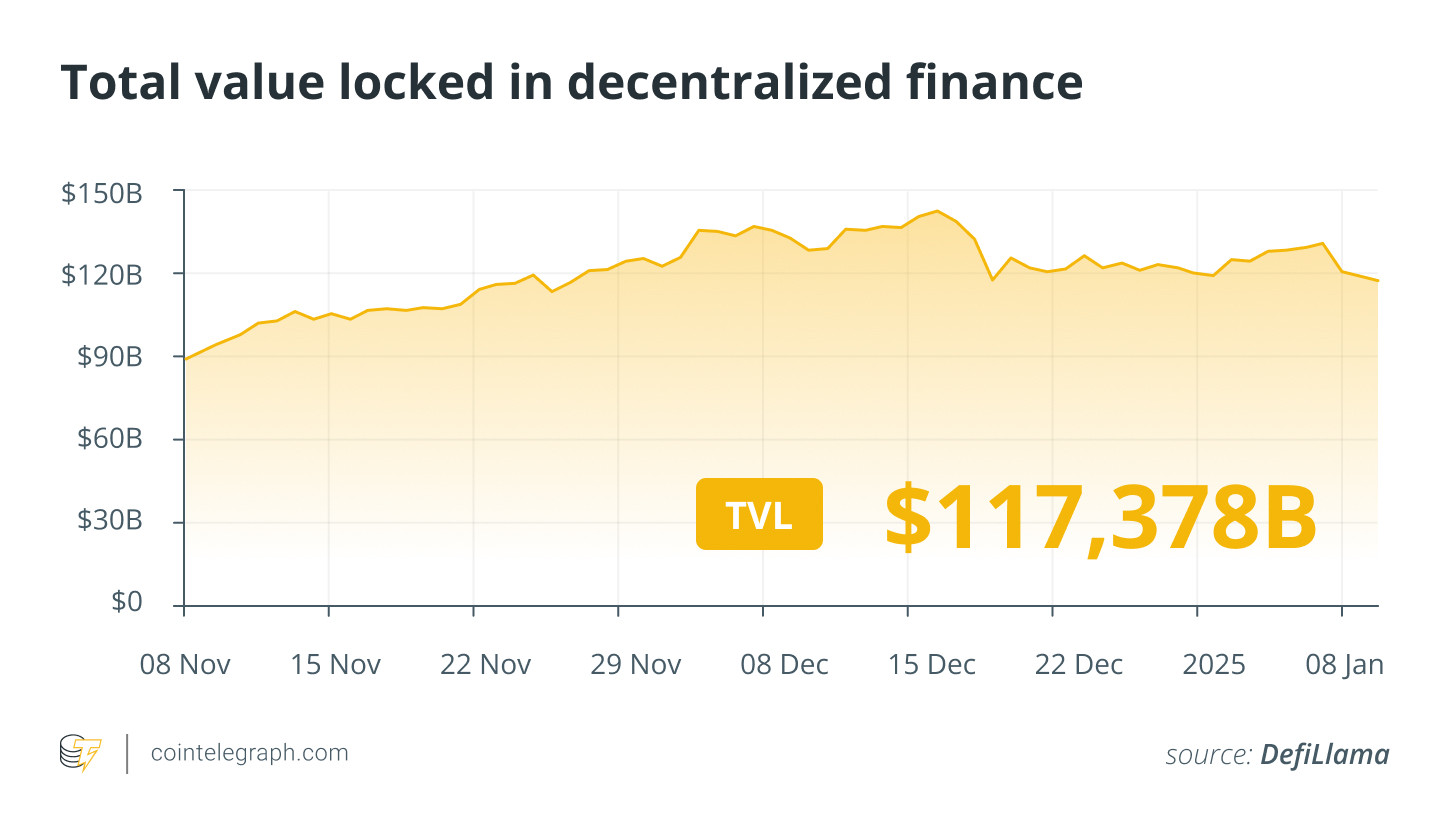

DeFi Weekly Market Recap

As the crypto market continues its rollercoaster ride, most major DeFi assets experienced a downturn this week. THORChain ($RUNE) was among the hardest hit, sinking by over 29%, followed closely by Virtuals Protocol ($VIRTUAL), which dropped 22% on the weekly charts.

At the same time, the total value locked (TVL) in DeFi remains a crucial indicator of market sentiment, with ongoing fluctuations hinting at broader adoption trends.

Total DeFi Value Locked

Total DeFi Value Locked

Total value locked in DeFi. Source: DefiLlama

Final Thoughts

Crypto never sleeps, and neither do we. With Solana’s ETF whispers, AI-infused blockchain efforts, evolving regulations, and juicy insider trading scandals, 2025 is already off to an electrifying start.

Stay tuned for next week’s roundup, where we’ll continue breaking down the hottest stories and trends shaping the crypto space.

Want more insights? Follow us for the latest updates on DeFi, blockchain, AI, and beyond! 🚀